M-AKIBA BOND FOR EVERYONE

M-Akiba bond is the first ever mobile-based government bond. It’s the most appropriate for small investors. If you have Sh. 3,000 you are good to start buying this bond.

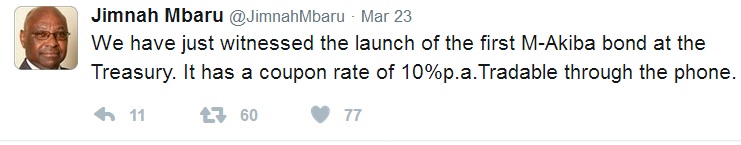

Kenya National Treasury has been toying a round with the idea of launching the M-Akiba Bond since October, 2015. This became a reality on 23rd March, 2017 when the Cabinet Secretary and PS for Kenya National Treasury presided over the Sh. 150 Million mini-launch of special limited offer.

Read More:

Main launch

Uhuru Kenyatta is expected to launch the main M-Akiba bond on June, 2017 which is targeting to raise Sh. 4.85 billion to finance infrastructure projects in Kenya.

Where can I buy the M-Akiba Bond?

Once it is launched in June, 2017 you can buy this bond at the capital markets (Nairobi Stock Exchange).

All you should know about M-Akiba

- Minimum capital required is Sh. 3,000 as compared to the previous Ksh. 50,000 for government bonds and Ksh. 100,000 for infrastructure bonds.

- M-Akiba will give you better returns than what you get as interest for your bank deposits.

- M-Akiba bond interest is tax-free

- M-Akiba bond will be traded on mobile money platforms (Safaricom, Airtel) meaning every Kenya can now invest in government bonds.

- Interest will be paid to investors every 6 months

- The Central Depository and Settlement Corporation will be the SELLING AGENT. This is a departure from the other government bonds because the selling agent is the Central Bank of Kenya.

Here are some reactions from around Twitter:

credit: screen shot on NSE twitter account

https://www.youtube.com/watch?v=9ssBgJVJnGk

Read more articles on this topic by following the links below:

M-Akiba Prospectus – Government of Kenya

Why M-Akiba is a game changer- by Jaindi Kisero

M-Akiba reaches 15% of day 2: by Edwin Okoth