Finance Bill 2021. The overall budget for FY 2021/22 is estimated at Kshs. 3.66 Trillion. The budget for the three arms of Government is estimated at; The Executive (Kshs. 1,895.14 Billion), Parliament (Kshs. 46.61 Billion) and the Judiciary (Kshs.17.92 Billion).

• On tax performance, the National Treasury has consistently set overambitious revenue targets during the budget making process. Actual tax revenue collection in 2019/20 was Ksh. 1,584 billion against the printed estimates target of Ksh. 1,758 billion. The National Treasury projects a total revenue collection of Ksh. 2,039 billion (16.4% of GDP) in 2021/22 of which, ordinary revenue will be Ksh. 1,776 billion (14.3% of GDP)

• Consolidated Fund Services (CFS) expenditures will amount to Kshs. 1.33 trillion in FY 2021/22. This is an increase by Kshs. 253.5 billion (24%) from the FY 2020/21 level and is projected to reach Kshs. 1.89 trillion by FY 2023/24. The CFS expenditure are mandatory obligations, and which attract the first charge on the taxes paid by citizens.

• A five-year review undertaken by Parliament Budget Office indicates that by the end of FY 2021/22, the CFS will have increased by over 150%, in absolute terms, since FY 2016/17. The annualized growth rate is 20%, which is much higher than the nominal GDP growth rate for the same period.

• As per the PBO report, It is noted that the CFS growth rate is attributed to debt servicing for the growing Public and Publicly Guaranteed Stock of debt, which, by end of March 2021, amounted to Ksh. 7.34 trillion or 82% of the Ksh. 9 trillion national debt ceiling and which comprised of Ksh. 3.57 trillion (49%) in domestic debt and Ksh. 3.77 trillion (51%) in external debt.

• In the FY 2021/22, Kshs. 1.17 trillion is dedicated to the debt stock servicing expenses which constitute 88% of CFS expenses. Of this amount domestic debt servicing will consume Kshs. 768.7 billion or 73% of the debt servicing expenditures illustrating that domestic borrowing bears a higher refinancing cost.

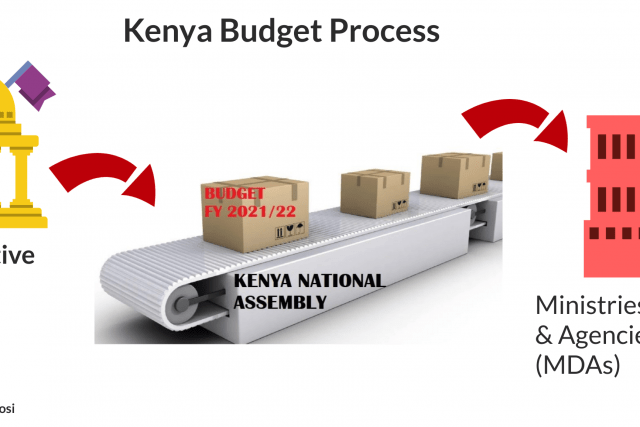

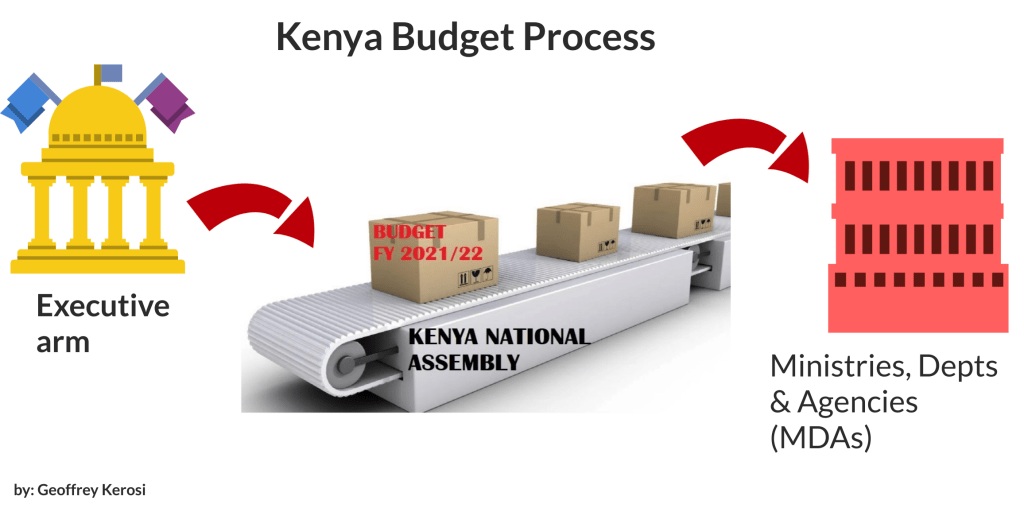

• The budget being submitted for approval by the National Assembly has gone against the resolutions made during the approval of the BPS and which is contrary to Section 38 (1)(a)(iii) and 38 (1) (f) of the PFM, Act, 2012. However, The National Assembly will go ahead and approve it.

• The National assembly granting approval to the budget estimates despite blatant ignorance of its own resolutions, indicates that citizen has lost the representation element with National Assembly becoming a conveyor belt of executive decisions.

• Over the medium term, the PBO notes that the development budget is poised to decline as a share of GDP from 5.8 percent of GDP in FY 2020/21 to 4.9 percent in FY 2021/22 with no clear reasons provided as why this is the case.

• The recently signed IMF programme which seeks to rationalize public investment projects does not seem to have significantly changed the business-as-usual practice of the Kenya government. The FY 21/22 budget as presented does not show extraordinary effort to streamline and prioritize investment spending to improve effectiveness of development expenditure;

• The Infrastructure, Energy & ICT sector has been allocated Kshs. 332.86 Billion in the budget estimates for FY 2021/22

• In the 2021/2022 budget, the health sector has been allocated Kshs. 121.09 Billion. Notably, there is an increase from the BPS ceiling mainly due to increased allocations for preventive and promotive health care. Covid-19 interventions have been allocated Kshs. 15.4 Billion; of which, Ksh. 3.9 billion is for the procurement of covid vaccines whereas Kshs. 9.5 billion is for engagement of 650 COVID 19 specialists: carrying out 591,000 tests and supplying 28 hospitals with equipment. The Ksh. 3.9 billion for the

procurement of vaccines is hardly adequate given the estimation that the cost of vaccinating 30% of the population is Kshs 34 Billion;

• In FY 2021/2022, the education sector has been allocated Kshs. 509.2 Billion. Even though this sector accounts for a significant portion of the budget, some funding gaps still exist. For instance, the Free-day secondary school programme is underfunded with an allocation of Kshs. 62.4 Billion against a requirement of Kshs. 74.5 Billion.

• For Financial Year 2021/2022, the Agriculture, Water and Environment sector has been allocated Kshs. 173.21 Billion. Like the health sector, the agriculture sector is heavily reliant on donor funding. It is estimated that 83% of its development budget is externally financed. Indeed, many of the conditional grants in the sector are from donors. This points to a lack of prioritization of the agriculture sector.

• In the FY 21/22 compensation to employees is estimated at Kshs. 528.15 Billion and Kshs. 480.5 Billion is for Semi-Autonomous Government Agencies (SAGAs)

• With regards to the Big Four Agenda Pillar 4 on Provision of Affordable and Decent Housing for all Kenyans. The government target was to deliver 500,000 housing units by 2022. By 2020, only 1,370 housing units in Park road project had constructed representing an achievement of 0.3% of target. In the budget estimates for FY 2021/22, there is an allocation of Kshs. 14.85 Billion (Ksh. 11 billion in the National Treasury and Ksh. 1.7 billion in the State Department for Housing & Urban Development) to deliver 3,336 units by the end of FY 2021/22;

• Allocation to the Big Four Agenda is approximately Ksh. 135 billion in the FY 2021/2022. This being the last year if the Jubilee administration, it signifies that many of the big four targets will not be met.

Finance Bill 2021 Highlights

• The finance bill 2021 proposes to Expand the definition of a permanent establishment in relation to income tax;

- Introduce 25 percent excise duty on imported glass;

o Provide for Duty on motorcycles other than motorcycle ambulances and locally assembled motorcycles is to be amended by replacing the amount of Ksh. 11,608.23 per unit with a 15 percent rate

o Introduce of 10 percent duty on jewellery

o Introduce duty of Ksh. 5,000 per Kg for products containing nicotine or nicotine substitutes intended for inhalation without combustion or oral application.

o Reintroduce Excise Duty on betting at a rate of 20 percent of the amount

wagered;

o To delete the requirement for regulations made under section 67 of the VAT ACT to be tabled before the National Assembly for approval before they take effect;

o Expand the list of goods exempt from VAT to include healthcare supplies such as Medical ventilators and the inputs for the manufacture of medical

ventilators, Diagnostic or laboratory reagents, Electro-diagnostic apparatus

and Ozone therapy, oxygen therapy, aerosol therapy, artificial respiration or

other therapeutic respiration apparatus as well as Other breathing appliances and gas masks, excluding protective masks having neither mechanical parts nor replaceable filters;

o introduce an exemption from digital service tax for activities that are

applicable for the tax but are carried out by entities that have a permanent

establishment in Kenya and are already paying relevant taxes.

Sources:

Finance bill highlights by Institute of Public Finance Kenya

FY 21/22 Shadow budget by Institute of Public Finance Kenya

Unpacking the Estimates of Revenue and Expenditure for 2021/2022 and the medium-term by the

parliamentary budget office

FY 2021/22 Program Based Budget and Budget Summary by National Treasury

Analysis done by Institute of Public Finance Kenya.